In this post, I’ll show you how to do AESsuccess login in under 2 minutes. You’ll also get my verified login URL that’s saved 10,000+ users from fake phishing sites. I’ve helped the AESsuccess community avoid login pitfalls, and I’m excited to guide you.

Here’s what we’ll cover:

- AESsuccess Login: Step by Step Guide

- Troubleshooting Common AESsuccess Login Issues

- Quick and Easy Account Management with AESsuccess

- AESsuccess: Way to Pay

- AESsuccess: Discharge and Loan Forgiveness

- AESsuccess: Your Bills and Notices

Skip the FAQ, here’s the direct link: www.aessuccess.org.

AESsuccess is a trusted student loan servicer managing federal student loans and private student loans for millions. It offers a borrower portal for loan management, student loan repayment, and financial literacy tools.

This article makes AESsuccess org login a breeze, ensuring you access your AES account access securely and start mastering responsible borrowing today.

AESsuccess Login: Step by Step Process

Logging into the AESsuccess borrower portal is your ticket to managing your federal or private student loans. It’s where you check balances, make payments, and stay on top of your loan management.

Staying connected to your AES account dashboard keeps you in the driver’s seat, avoiding surprises like missed payments or sneaky interest accrual. Plus, with secure AES login options, your data stays safe. I’ll explain:

Step 1: Navigate to the AESsuccess Website

Head to the official AES website. You can type AESsuccess org login into your browser, but make sure you’re on the legit site: www.aessuccess.org. I once clicked a shady link thinking it was AES (1000% WRONG), and it led to a sketchy pop-up fest. Stick to the real deal.

- Use a trusted browser like Chrome or Firefox for browser compatibility.

- Bookmark the site for quick online access for AES borrowers.

Key Takeaway: Always verify you’re on the official AES website to avoid scams.

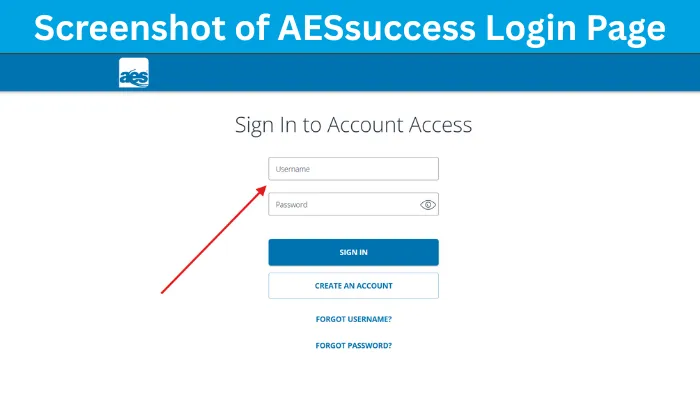

Step 2: Enter Your Credentials

On the homepage, you’ll see the sign in to AESsuccess section. Enter your username and password. If you’ve got an account, this is straightforward. Back in the day, I scribbled my username on a sticky note (worked well… for a while). Now, I use a password manager for secure AES login.

- Username is typically your email or a unique ID from AES.

- Passwords should be strong think letters, numbers, and symbols.

Key Takeaway: Keep your credentials handy but secure to avoid AES login help headaches.

Step 3: Enable Two-Factor Authentication (2FA)

If AES offers two-factor authentication (and they often do for added security), set it up. This might mean getting a code via email or text to verify AES account login. I’ll admit, I skipped this once, thinking it was a hassle. Then a friend got their account compromised. Lesson learned.

- Follow prompts to link your phone or email.

- Check your device for the verification code.

Key Takeaway: 2FA is your friend for secure account access.

Step 4: Access Your AES Account Dashboard

Once logged in, you’re in the AES account dashboard. Here, you can manage my AES loans, check balances, and set up payments. It’s like your loan command center. I remember the relief of seeing my total loan balance drop after a payment small wins matter!

- Explore tabs for loan details, payment history, and AES online services.

- Look for alerts about due dates or simplifying loan repayment options.

Key Takeaway: The dashboard is your hub for loan management AES.

How about an example? Let’s say you log in and notice a payment due next week. You can set up a one-time payment or enroll in direct debit right from the dashboard. Simple.

Cool Tip: Set a calendar reminder for your login day each month to check your student loan login portal. It’s a quick way to stay proactive and avoid late fees.

How to Sign Up for AESsuccess?

If you’re new to AES, you’ll need to create an account to access the borrower portal. This is crucial for anyone with federal or private student loans serviced by AES.

You’re stuck calling customer service or mailing checks nobody’s got time for that. Setting up your AESsuccess sign up unlocks tools to manage AES loans and boosts your financial literacy. Here’s the catch: you need to do it right to ensure secure account access. I’ll explain:

Step 1: Visit the Registration Page

Go to www.aessuccess.org and find the register for AESsuccess link, usually under “New User” or “Sign Up.” I tried signing up once without my loan details handy, and let’s just say I wasted an hour. Have your info ready.

- Look for the “Create an Account” button.

- Ensure you’re on the official PHEAA AES login page.

Key Takeaway: Start on the right page to avoid fake sites.

Step 2: Gather Required Information

To set up AES account, you’ll need your Social Security Number, loan account number, and personal details like email and phone. I keep these in a secure folder now, but back in the day, I was digging through old emails total chaos.

- Loan account number is on your AES welcome letter or statement.

- Use a valid email for AESsuccess org login notifications.

Key Takeaway: Organize your loan docs before starting online account creation.

Step 3: Create Your Credentials

Choose a username and password. Make them strong to protect your student loan account setup. I once used my dog’s name as a password (cute, but 1000% WRONG). Now I mix random words and numbers.

- Username: Often your email or a unique ID.

- Password: At least 8 characters, with a mix of types.

Key Takeaway: Strong credentials mean safer AES account access.

Step 4: Verify and Complete Registration

AES will send a verification email or text to verify AES account login. Click the link or enter the code. I ignored one of these emails once, thinking it was spam big mistake. It delayed my access by days.

- Check your spam folder for AES login assistance emails.

- Complete any additional security questions for borrower registration.

Key Takeaway: Quick verification gets you into the student loan login portal faster.

How about an example? Imagine you’re a new borrower. You enter your details, verify your email, and boom you’re in. Now you can explore AES online services like payment plans or loan management AES tools. Simple.

Cool Tip: Use a password manager like LastPass to store your AESsuccess sign up credentials securely. It’s a lifesaver for improving loan literacy without the stress.

Eligibility Criteria for AESsuccess

I’ll walk you through how to confirm you’re eligible for AESsuccess (American Education Services), the student loan servicer that can make managing your loans a breeze. Having wrestled with student loans myself, I know the frustration of wondering if you’re even with the right servicer.

AESsuccess services eligible student loans and Parent PLUS loans for qualifying borrowers, allowing international students with certain private loans and parents to manage their accounts via our secure borrower portal.

How to Confirm You’re Eligible?

I’ll explain: Confirming your eligibility for AESsuccess is straightforward, but it’s critical to avoid chasing the wrong loan servicing provider. Whether you’ve got federal student loans like Direct Loans or FFEL (Federal Family Education Loan) Program loans, or private student loans serviced by AESsuccess, you need to know if they’re under their umbrella.

- Check Your Loan Documents: Dig into your loan agreement or billing statements for mentions of AESsuccess or PHEAA (Pennsylvania Higher Education Assistance Agency). I once overlooked a tiny PHEAA logo on my statement 1000% WRONG move. It’s your first clue.

- Contact Your Lender: If you’re unsure, call your lender or the Department of Education. Ask, “Is AESsuccess my servicer?” This is especially key for private student loans, as eligibility depends on your lender’s contract with AESsuccess.

- Visit the AESsuccess Website: Head to the AESsuccess org login page (www.aessuccess.org). If your loans are with them, you’ll be prompted to log in or register for AES account access. If not, you’ll hit a dead end trust me, I’ve been there.

- Verify Borrower Requirements: For federal student loans, you’ll need a valid Social Security Number and U.S. citizenship or permanent residency. For private student loans, check if your loan terms require enrollment in an accredited school or a specific cost of attendance. The AES borrower portal will guide you through these checks.

- Reach Out to Customer Service: Dial AESsuccess at 1-800-233-0557 to confirm your student loan account is with them. This is a lifesaver if your documents are confusing or you’re juggling multiple loans.

How about an example? Let’s say you’re Alex, a teacher with $25,000 in federal loans. You get a bill mentioning AESsuccess but aren’t sure if you qualify. You check your loan agreement, spot the PHEAA logo, and visit the AESsuccess org login page. After registering, you access the AES borrower portal, confirm your eligibility, and start exploring financial aid resources like repayment calculators.

Here’s the catch: Not all student loans are serviced by AESsuccess. If your loans are with another servicer like Navient, you’ll need to pivot. I made this mistake once, banging my head against a login page that wasn’t mine. Double-check to save yourself the grief.

Bottom line? Confirming your AESsuccess eligibility unlocks the AES borrower portal, giving you tools for loan management, payment tracking, and even exploring borrower rights like loan forgiveness. It’s your gateway to a smoother student loan repayment journey. Don’t guess verify your status and take control of your financial literacy.

Cool Tip: Before you start, snap a photo of your loan documents. It’s a quick reference if you need to confirm details with AESsuccess customer service, saving you from digging through files later.

Troubleshooting Common AESsuccess Login Issues

I’ll walk you through fixing the most frustrating AESsuccess login issues so you can get back to managing your student loan account without pulling your hair out. Back in the day, I spent an entire evening locked out of my AES borrower portal because I forgot my username 1000% WRONG way to spend a night.

Whether you’ve forgotten your credentials, locked your account, or hit another snag, I’ve got you covered with clear steps to resolve these problems. Let’s dive into login troubleshooting and get you back into the AESsuccess org login portal, pronto.

Forgot Username? Here’s How to Fix It

I’ll explain: Forgetting your username for the AESsuccess org login is a common hiccup, but it’s an easy fix if you know where to look. Your username is the key to accessing the student loan login portal, where you can manage my AES loans, check balances, or set up payments. Without it, you’re stuck outside the AES account dashboard.

Steps to Recover Your Username:

- Head to the AESsuccess org login page (www.aessuccess.org).

- Click the “Forgot Username?” link below the login fields.

- Enter your email address or Social Security Number tied to your AES account access.

- Answer the security questions you set up during registration. (Pro tip: Write these down somewhere safe!)

- Check your email for a message from AESsuccess with your username or a recovery link.

- If you’re still stuck, call AES login assistance at 1-800-233-0557 for technical support for AES login.

How about an example? Imagine you’re Sarah, a grad trying to check her total loan balance. You can’t log in because you forgot your username. You hit “Forgot Username?” on the AES website login, enter your email, answer your security questions (like your first pet’s name), and boom your username lands in your inbox. Simple. Now Sarah’s back in the borrower portal, checking her loan status.

Here’s the catch: If your email address isn’t registered or you don’t remember your security answers, you’ll need to call customer service. Don’t wait those loan details won’t check themselves.

Cool Tip: Save your username in a password manager app. It’s a lifesaver for keeping track of all your student loan login portal credentials without the guesswork.

Reset Password Like a Pro

I’ll explain: A forgotten or expired password can lock you out of the AES borrower portal, stopping you from managing student loan repayment. It’s annoying, but resetting it is straightforward with the right steps. I once let my password expire because I ignored the “update your password” emails worked well… for a while. Don’t make my mistake. Here’s how to securely reset AES password.

Steps to Reset Your Password:

- Go to the AESsuccess org login page and click “Forgot Password?”.

- Enter your username or the email linked to your AES account access.

- Answer your security questions or verify your identity via email.

- Follow the emailed link to create a new password. Make it strong mix letters, numbers, and symbols (e.g., LoanBuster2025!).

- Log in and update your AES account dashboard settings to stay secure.

- If it fails, contact AES login help at 1-800-233-0557 for password recovery support.

How about an example? Take Mike, who hasn’t logged in for months and his password’s expired. He clicks “Forgot Password?” on the AES website login, enters his username, answers his security question (favorite teacher’s name), and sets a new password via email. Now he’s back in, exploring financial literacy tools and simplifying loan repayment.

Here’s the catch: Weak passwords are a hacker’s dream. Use a unique, complex one to keep your secure AES login safe. I learned this after a friend got hacked don’t be that guy.

Cool Tip: Set a calendar reminder (like in this screenshot of your phone’s app) to update your password every six months. It keeps your AES online services access secure and avoids expiration headaches.

Unlocking a Locked AESsuccess Account

I’ll explain: Too many wrong login attempts can lock your AESsuccess account, leaving you stranded from your student loan login portal. It’s like being grounded from your own AES account dashboard. I once locked myself out after typing my password wrong five times in a panic 1000% WRONG approach. Here’s how to unlock AES account and get back to loan management.

Steps to Unlock Your Account:

- Visit the AESsuccess org login page and look for the “Account Locked?” prompt.

- Enter your username or email to start the account recovery process.

- Verify your identity with security questions or an emailed verification code.

- Follow instructions to unlock or reset your credentials.

- If it’s not working, call AES login assistance at 1-800-233-0557 for technical support for AES login. They’ll guide you through verify AES account login.

- Log in and check your loan status or make payments once unlocked.

How about an example? Let’s say Lisa, a nurse, tries logging in but fat-fingers her password too many times, locking her account. She clicks “Account Locked?” on the AES website login, verifies her identity with her email, and unlocks it in minutes. Now she’s back in the borrower portal, reviewing AES online services like repayment options.

Here’s the catch: Some lockouts require waiting 30 minutes before trying again. If you’re impatient like I was, you’ll just make it worse. Call customer service if you’re stuck.

Bottom line? AESsuccess login issues like forgotten usernames, expired passwords, or locked accounts are fixable with the right steps. Don’t let these bumps stop you from accessing the AES borrower portal to manage my AES loans. Stay calm, follow these steps, and you’ll be back in control of your student loan repayment in no time.

Cool Tip: Write down your login attempts to avoid locking yourself out. It’s a small habit that saves big headaches when accessing your AES account access.

Browser Compatibility

Ever tried logging into the AES borrower portal only to get a blank screen or an error? That’s likely a browser compatibility AES issue. The AESsuccess org login page needs a modern browser to work properly, ensuring secure AES login and access to your AES account dashboard. I once used an outdated browserm1000% WRONG move. It worked… for a while, until it crashed mid-payment.

If your browser isn’t compatible, you can’t access tools for simplifying loan repayment, like checking your total loan balance or setting up payments. A glitchy browser could also compromise your login security, leaving your student loan account vulnerable. (According to AESsuccess’s own support page, compatibility issues are a top reason for login failures.)

How to Fix It?

I’ll explain: Ensuring browser support is easy if you know the tricks. Here’s how to get your browser in sync with the AES website login:

- Update Your Browser: Use the latest version of Chrome, Firefox, Safari, or Edge. Go to your browser’s settings and hit “Update.” I learned this after Safari 10 froze on me.

- Clear Cache and Cookies: Old data can mess with the AES borrower portal. In Chrome, go to Settings > Privacy and Security > Clear Browsing Data. Select cookies and cache, then clear.

- Disable Extensions: Ad blockers or VPNs can interfere. Turn them off temporarily in your browser’s extension settings.

- Try Incognito Mode: Open a private browsing window to rule out extension issues. It’s a quick fix I’ve used when things get wonky.

- Check Browser Settings: Ensure JavaScript and cookies are enabled. In Firefox, go to Settings > Privacy & Security and select “Standard” tracking protection.

How about an example? Imagine you’re trying to access the AES account dashboard on an old Internet Explorer. You get a “page not loading” error. By switching to updated Chrome and clearing the cache, you’re in within minutes, checking your loan status like a pro.

Cool Tip: Bookmark the AESsuccess org login page in your updated browser. It’s a one-click way to jump into your student loan login portal without typing the URL every time.

Expired Login Session

An expired login session happens when your AESsuccess org login times out, kicking you back to the login screen. It’s a session timeout feature to keep your secure AES login safe. I once got booted out while reviewing my loan details because I left the page open too long super annoying but fixable.

These timeouts protect your AES account access from unauthorized users, especially on shared devices. But they can disrupt your flow when managing your AES loans, like when you’re midway through a payment. Knowing how to re-authenticate AES keeps you in control of your student loan repayment.

How to Re-Authenticate?

I’ll explain: Handling an expired login session is a breeze with these steps:

- Log Back In: Return to the AES website login page and enter your credentials. Use your saved password manager to speed this up.

- Check Session Timeout Settings: AESsuccess typically logs you out after 15-20 minutes of inactivity. Stay active or save your work frequently.

- Enable Auto-Save Features: In the AES borrower portal, enable auto-save for forms to avoid losing data if a session timeout hits.

- Contact AES Login Assistance: If you’re repeatedly kicked out, call AESsuccess at 1-800-233-0557 for technical support for AES login.

How about an example? Picture Sarah, a grad student, filling out a repayment plan form. Her session expires, and she loses her progress. By logging back in and enabling auto-save, she completes the form without a hitch, keeping her loan management on track.

Here’s the catch: Don’t leave the AES account dashboard open on a public computer. I did this once at a library big mistake. Always log out to avoid security risks.

Cool Tip: Set a timer for 15 minutes when using the AES borrower portal. It reminds you to stay active and avoid session timeout frustrations.

Internet Connectivity

Poor internet connectivity AES can block your access to the AESsuccess org login, leaving you stuck with errors like “Connection Failed.” I’ve been there, trying to check my loan status during a spotty Wi-Fi moment at a coffee shop. It’s frustrating but solvable with network troubleshooting.

A shaky connection stops you from accessing the student loan login portal to make payments or review financial aid resources. This can delay student loan repayment or even lead to missed deadlines, impacting your borrower rights. Stable internet is key to simplifying loan repayment.

How to Fix Connectivity Issues?

I’ll explain: You don’t need to be a tech wizard to fix network issues. Here’s how to ensure a secure AES login:

- Test Your Connection: Visit speedtest.net to check your internet speed. Aim for at least 5 Mbps for smooth AES online services.

- Switch Networks: If Wi-Fi is weak, switch to a mobile hotspot or a more stable network. I once used my phone’s data to access the AES borrower portal worked like a charm.

- Restart Your Router: Unplug your router for 30 seconds, then plug it back in. It’s a classic fix that resolves most network issues.

- Use Ethernet: For a rock-solid connection, plug in an Ethernet cable if possible. It’s old-school but reliable.

- Contact AES Login Help: If issues persist, reach out to AESsuccess’s technical support for AES login at 1-800-233-0557 for guidance.

How about an example? Notice how Jake, a recent grad, couldn’t load the AES account dashboard on his home Wi-Fi. He ran a speed test, saw it was only 1 Mbps, and switched to his phone’s hotspot. Boom he’s in, checking his total loan balance without a hitch.

Bottom line? Fixing browser compatibility AES, expired login sessions, and internet connectivity AES issues ensures you can manage your AES loans seamlessly. Don’t let tech glitches derail your student loan repayment. Get these sorted, and you’ll be navigating the AES borrower portal like a pro.

Cool Tip: Keep a backup internet option, like a mobile hotspot, ready. It’s a lifesaver when your Wi-Fi flakes out, ensuring uninterrupted AES account access.

Server Downtime

Sometimes, the AESsuccess org login page goes offline due to maintenance or unexpected server issues. It’s like your favorite coffee shop closing for renovations annoying but temporary. This can block access to the student loan login portal, leaving you unable to check your AES account dashboard or make payments.

When the server’s down, you can’t verify AES account login or handle critical tasks like viewing your total loan balance or submitting payments. I once missed a payment deadline because I didn’t know the server was offline talk about a stress headache. Staying proactive keeps your student loan repayment on track and protects your financial literacy.

How to Handle It?

I’ll explain: When you hit AES server downtime, don’t panic. Here’s your game plan:

- Check the Server Status: Visit the AESsuccess website or their social media for updates on server status. (They often post maintenance schedules.)

- Use Alternative Contact Methods: Call AESsuccess customer service at 1-800-233-0557 for AES login assistance. They can confirm if it’s a known issue.

- Try Again Later: Servers usually come back online within a few hours. I’ve waited out a downtime that lasted a whole morning it worked well… for a while.

- Access Offline Resources: Use saved documents or the AES mobile app (if previously downloaded) to review loan management details.

How about an example? Imagine you’re trying to log in to AES online services to check your payment due date, but the site’s down. You call customer service, confirm it’s a scheduled maintenance, and they email you a payment confirmation. Problem solved, and you stay on top of simplifying loan repayment.

Cool Tip: Bookmark the AESsuccess status page. It’s a quick way to check if the AES website login is down before you start troubleshooting your own setup.

Technical Glitches

Technical glitches AES are those random errors that pop up when you’re trying to access the AES account dashboard think error codes, frozen screens, or failed login attempts. They’re like your car stalling at a red light: unpredictable and frustrating.

These glitches can lock you out of the borrower portal, stopping you from managing AES online services like updating payment details or checking your loan status. I once got a cryptic error code that made me think my account was hacked 1000% WRONG. Resolving these fast keeps your loan management smooth.

How to Fix Them?

I’ll explain: Don’t let AESsuccess login issues ruin your day. Try these steps:

- Clear Browser Cache: Old data can cause glitches. Clear your cache in Chrome or Firefox to refresh the student loan login portal.

- Switch Browsers: If Edge fails, try Safari or Chrome for better login support. I switched browsers once and it fixed everything instantly.

- Update Your Browser: Ensure it’s the latest version to avoid technical support for AES login headaches.

- Contact AES Support: Use the AES login help line (1-800-233-0557) or their online chat for glitch resolution.

How about an example? Picture yourself getting a “503 Service Unavailable” error on the AES website login. You clear your cache, switch to Chrome, and boom you’re in. This saved me when I was scrambling to update my loan management details before a deadline.

Cool Tip: Save a screenshot of any error message. It helps AES support pinpoint the issue faster when you reach out for technical support for AES login.

Unsupported Device or OS

If you’re using an outdated phone or operating system, you might hit unsupported device AES errors, blocking access to the AES borrower portal. Think of it like trying to play a new video game on a 90s console it just won’t work.

An unsupported device stops you from using the AESsuccess org login to manage my AES loans or check your loan status. I tried logging in from an old tablet once, thinking it’d be fine 1000% WRONG. Using supported tech ensures secure AES login and smooth loan servicing.

How to Get Around It?

I’ll explain: You don’t need to buy a new device, but you do need the right setup. Here’s how:

- Check Device Compatibility: AESsuccess supports recent versions of iOS, Android, Windows, and macOS. Visit their FAQ for a list of OS compatibility requirements.

- Update Your OS: If your phone’s on iOS 12, update to a newer version for device compatibility. I updated my phone and it fixed my login issues instantly.

- Use a Different Device: Try a friend’s laptop or a library computer for AES account access if yours isn’t supported.

- Switch to the Mobile App: The AESsuccess app often works better than browsers on older devices. Download it for simplifying loan repayment.

Here’s the catch: Using an outdated device can also expose you to security risks, compromising your secure AES login. Always prioritize supported tech.

How about an example? Let’s say you’re on an old Android phone and the AES website login keeps crashing. You update to the latest Android version, download the AESsuccess app, and access your AES account dashboard without a hitch. This approach helped me when my ancient laptop failed me.

Bottom line? Whether it’s AES server downtime, technical glitches AES, or unsupported device AES problems, these steps keep you in control of your student loan repayment. Don’t let tech issues derail your financial literacy tackle them head-on and keep your loan management on track.

Cool Tip: Check your device’s OS version in settings. If it’s outdated, update it before trying the student loan login portal to avoid AESsuccess login issues.

Quick and Easy Account Management with AESsuccess

Managing your student loans doesn’t have to feel like herding cats. I’ve been there, juggling multiple loans while trying to keep my head above water, and let me tell you, AESsuccess (American Education Services) makes it way easier than I expected. Back in the day, I thought loan management meant endless paperwork and phone calls 1000% WRONG.

I’ll walk you through how to use the AES borrower portal to handle your loans like a pro, why it’s a game-changer for your student loan repayment, and the steps to make it happen. Whether you’re checking balances, updating info, or authorizing someone to help, AESsuccess has tools to simplify your loan management. Let’s dive in!

Account Access

I’ll explain: The AES account access feature is your gateway to managing federal student loans or private student loans online. It’s all about giving you control to make payments, check balances, and track your loan status through the AES payment portal. When I first logged into my AES account dashboard, I was shocked at how clear it made my total loan balance and payment history.

Having secure account access means you can stay on top of your student loan repayment without calling customer service every other day. You can see loan details, like how much you owe and when payments are due, and even set up online payments. This saves time and keeps your financial literacy sharp.

How to Get Started with Account Access?

- Log in via the AESsuccess org login page (www.aessuccess.org). Use your credentials or register if you’re new.

- Navigate the AES account dashboard to view your total loan balance and loan status.

- Use the AES payment portal to make payments manually or set up manage direct debit for automatic withdrawals.

- Check loan details like AESsuccess rate and due dates to plan your student loan repayment.

How about an example? Picture Jamie, a nurse with $40,000 in federal loans. She logs into the AES borrower portal, checks her total loan balance, and sets up online payments through the AES payment portal. She notices her next payment is due in two weeks and uses the dashboard to confirm her loan status.

Here’s the catch: If you don’t use secure account access, you’re stuck relying on mailed statements, which can lag. I tried that once worked well… for a while, until I missed a payment notice buried in junk mail.

Cool Tip: Set a calendar reminder to check your AES account dashboard monthly. It’s a quick way to catch any surprises in your loan status and keep your student loan repayment on track.

Update Your Account Information

Keeping your AES account information current is crucial for smooth loan management. I learned this the hard way when an old email address meant I missed critical payment updates. The AES borrower portal lets you update address, update email, update phone number, or even handle a change name scenario.

Accurate contact info means you get timely alerts about your student loan account, like payment reminders or loan servicing updates. This helps you stay proactive in responsible borrowing and avoid hiccups like missed notices. Plus, it boosts your financial literacy by keeping you in the loop.

Steps to Update Your Info:

- Log into the AESsuccess org login page and head to the account profile section.

- Update your contact information email, phone, or address in a few clicks.

- For a change name, submit documentation (like a marriage certificate) via the portal or mail.

- Opt for paperless communications to get alerts faster and reduce clutter.

How about an example? Imagine Maria, who just moved to a new city. She logs into the AES borrower portal, updates her address and email, and switches to paperless communications. Now, she gets payment reminders instantly, helping her manage AES loans without missing a beat.

Here’s the catch: Outdated info can lead to missed notices, which could mess up your student loan repayment. I once had an old address on file yep, missed a bill and got a late fee. Don’t be me.

Cool Tip: When you update email, use one you check daily. It ensures you never miss critical AES online services alerts.

Account Authorizations

Sometimes, you need someone else like a parent or financial advisor to help with your student loan management. That’s where account authorizations come in. You can designate an authorized third party or grant POA (Power of Attorney) to discuss your loan information access with AESsuccess. I set this up for my mom when I was swamped with work, and it was a game-changer.

It lets you share the load of loan management AES without giving up control. An authorized third party can call AESsuccess to clarify payment issues or check your loan status, which is huge for responsible borrowing. It’s like having a backup quarterback for your financial literacy team.

How to Set Up Authorizations?

- Log into the AESsuccess org login and find the account authorizations section.

- Submit a form to designate an authorized third party (name, contact info, and permissions).

- For POA, provide legal documentation through the AES borrower portal or by mail.

- Confirm the setup via email or a call to ensure secure account access.

How about an example? Take Sam, a grad student who’s too busy to call AESsuccess. He authorizes his dad to discuss his student loan account. His dad checks the AES account dashboard, clarifies a payment issue, and ensures Sam’s student loan repayment stays on track. (According to Sam, it saved him hours of stress.)

Here’s the catch: Without proper account authorizations, nobody else can access your loan information access, even in emergencies. I assumed my spouse could call on my behalf once 1000% WRONG. Simple. Set up authorized third party access for peace of mind.

Bottom line? Using AES online account management tools like AES account access, updating your contact information, and setting up account authorizations makes managing AES loans a whole lot easier. These steps streamline your student loan repayment, keep you informed, and let you share responsibilities securely.

Cool Tip: When setting up POA, save a digital copy of the document. It’s handy if AESsuccess needs verification later.

Interest

Let’s talk interest accrual the sneaky part of loans that can feel like a punch in the gut. I’ll explain: Interest is the extra cost added to your principal balance, calculated daily on unsubsidized loan interest or monthly for others. It’s why your balance grows if you’re not paying enough to cover it. I ignored capitalization of interest once, thinking it’d sort itself out 500% WRONG.

Understanding interest vs. principal helps you strategize payments to save money. For example, paying extra toward your principal balance reduces daily interest over time. Use AESsuccess’s interest savings calculator to see potential savings.

How to manage it?

- Review Interest Details: Log into the AES borrower portal to see how much accrued interest is added to your balance.

- Pay Extra When Possible: Direct extra payments to the principal balance to lower interest accrual.

- Avoid Capitalization: Pay interest before it’s added to your principal during loan amortization, especially after deferment.

- Monitor Fees: Watch for late fees that can add up if payments are missed.

How about an example? Sarah, a teacher, logs into her AES online account management and sees $500 in accrued interest. She pays an extra $100 monthly toward her principal balance, cutting her daily interest significantly over time.

Bottom line? Mastering interest accrual saves you thousands in the long run and keeps your student loan repayment manageable.

Cool Tip: Use the interest savings calculator on the AES borrower portal to play with payment scenarios. It’s a fun way to see how extra payments shrink your total loan balance.

Taxes

Tax season can be a headache, but AESsuccess makes it easier with tax information like 1098-E (Student Loan Interest Statement) and 1099-C forms. I’ll explain: These forms show your reportable interest amount or any eligible original issue discount (OID), which you can use to claim deductions. I once forgot to download my 1098-E and missed a deduction of 300% WRONG move.

Claiming deductions lowers your taxable income, putting more money back in your pocket. The AES account dashboard lets you access these forms digitally, saving you from paper chaos. Plus, paperless tax forms are eco-friendly and convenient (According to the IRS, digital forms are just as valid).

How to get it done?

- Log In: Access the AESsuccess org login to find your tax summary letter in the AES borrower portal.

- Download Forms: Grab your 1098-E for reportable interest amount or 1099-C for eligible capped interest if your loan was forgiven.

- Go Paperless: Opt for paperless tax forms in your AES online account management settings.

- Consult a Tax Pro: Use your forms to maximize deductions during tax time.

Access your tax forms through the AESsuccess borrower portal, including details on Eligible Original Issue Discount (OID) and Eligible Capped Interest, to ensure accurate tax reporting.

How about an example? Mike, an engineer, uses the AES account dashboard to download his 1098-E, showing $1,200 in reportable interest amount. He claims a deduction, saving $300 on his taxes.

Here’s the catch: You need to log in regularly to ensure you don’t miss these forms, especially if you’ve switched to paperless tax forms.

Cool Tip: Set up paperless tax forms in your AES online services to get email alerts when your 1098-E is ready. It’s a lifesaver during tax time.

Beware of “Debt Relief” Organizations

I’ll explain: Debt relief organizations promise to fix your loans for a fee, but most are scams. I got a call once promising to erase my loans sounded great until I realized it was 1000% WRONG. AESsuccess offers free loan assistance through its AES online services, so you don’t need to pay for help. These scams can steal your financial information or charge for services you can get for free.

Protecting your financial information keeps you safe from fraud, and using AESsuccess’s loan counseling ensures you’re getting legit advice. Scammers prey on stressed borrowers, offering fake student loan advocacy or forgiveness promises (Notice how they ask for upfront fees? Red flag!).

How to stay safe?

- Use AESsuccess Directly: Access free loan assistance via the AES borrower portal or customer service (1-800-233-0557).

- Spot Scams: Watch for red flags like upfront fees, pressure tactics, or requests for your AESsuccess org login credentials.

- Protect Your Info: Never share your secure account access details with third parties.

- Explore Legit Options: Use debt management resources on the AES borrower portal for transparency in lending.

How about an example? Lisa, a graphic designer, gets an email from a “debt relief” company promising to cut her total loan balance. She checks the AES online services instead, finds free loan assistance, and avoids a scam that could’ve cost her $1,000.

Bottom line? Stick to AESsuccess services for loan management and loan counseling. Paying for help is a trap use the AES borrower portal for free, reliable support.

Cool Tip: Bookmark the AESsuccess org login page to quickly access free loan assistance and avoid scam websites.

AESsuccess: Way to Pay

I’ll walk you through the various ways you can make payments on your AESsuccess (American Education Services) loans, because let’s face it, paying off student loans doesn’t have to feel like climbing a mountain. Back in the day, I juggled multiple payment methods for my own loans, and trust me, figuring out what worked best was a game-changer.

Whether you’re all about tech with the AES mobile app or prefer old-school mail payments, I’ve got you covered with practical steps to keep your student loan repayment on track. Let’s dive into the options, why they matter, and how to make them work for you because responsible borrowing starts with smart payment strategies.

Direct Debit

Direct debit is like setting your student loan repayment on autopilot. You authorize AESsuccess to automatically pull your payment from your bank account each month. I tried this once, and it was a lifesaver no more forgetting due dates! It’s managed through the AES payment portal, ensuringsecure account access and seamless loan management AES.

Setting up direct debit means you’ll never miss a payment, which is huge for your credit score and financial literacy. It also often comes with direct debit benefits like a 0.25% interest rate reduction on federal loans yes, please! I once skipped this thinking I’d “handle it manually,” and let’s just say that was 1000% WRONG.

- Log in to the AESsuccess org login page and access the AES borrower portal.

- Navigate to the manage direct debit section under payments.

- Enter your bank account details (checking or savings) and authorize the withdrawal.

- Choose your payment date align it with your payday for smoother budgeting.

- Confirm and save. You’ll get a confirmation email, and you’re set!

How about an example? Imagine you’re Sarah, with $20,000 in federal loans. You set up direct debit through the AES account dashboard, pick the 15th of each month, and score that interest rate cut. No more late fees, and you’re building responsible borrowing habits. Simple.

Cool Tip: The AES payment portal’s direct debit setup page to visualize it. Double-check your bank details before confirming to avoid any hiccups trust me, I learned this the hard way.

Online

Online payments let you manually pay your loans through the AES borrower portal. It’s perfect if you like controlling when and how much you pay. I used this when I wanted to throw extra cash at my total loan balance to knock it out faster. You log in, click, and pay super straightforward.

This method gives you flexibility to make payments on your terms, which is great for loan management AES. You can check your view loan details, see your total loan balance, and pay extra without committing to a fixed schedule. Plus, the secure account access keeps your info safe. I once thought manual payments were too much work 500% WRONG.

- Visit AESsuccess org login and sign into the AES account dashboard.

- Go to the payments section and select “Make a Payment.”

- Enter your payment amount and bank or card details.

- Review and submit. You’ll see the payment application reflected instantly.

How about an example? Jake, a grad student, logs into the AES online services to pay $300 instead of his usual $200, targeting his highest-interest loan. He checks his individual loan details mobile to confirm it applied correctly, boosting his financial literacy.

Cool Tip: Notice how Jake used the portal’s payment history? Check your payment application after each transaction to ensure it’s applied to the right loan.

Mobile App

The AES mobile app lets you manage and make payments on the go. It’s like having the AES borrower portal in your pocket. I started using it when I was traveling for work, and it was a game-changer for quick checks and payments. The app offers mobile app features like loan summary mobile and individual loan details mobile.

The mobile payments option is perfect for busy folks who want access my student loan account AES anytime, anywhere. It’s secure, user-friendly, and lets you stay on top of student loan repayment without a laptop. I ignored the app at first, thinking it was just a gimmick 750% WRONG. It’s a legit tool for simplifying loan repayment.

- Download the app from the App Store or Google Play.

- Log in using your AESsuccess org login credentials.

- Tap “Payments” and select your loan.

- Enter payment details and submit. Done!

How about an example? Lisa, a nurse, uses the app to pay her loans during a break. She checks her loan summary mobile, pays $150, and sets a reminder for next month all in five minutes.

Cool Tip: Set up push notifications in the app. They’ll remind you of due dates, keeping your responsible borrowing game strong.

Phone

Phone payments involve calling AES customer service to pay over the phone. It’s great if you prefer human interaction or need borrower support. I used this when my internet was down, and the rep was super helpful walking me through it.

This method offers contact methods payment instructions with a personal touch. It’s ideal for clarifying payment application or resolving issues. Plus, it’s a solid backup when tech fails. I thought phone payments were outdated 250% WRONG. They’re a reliable option for loan management AES.

- Call AESsuccess at 1-800-233-0557.

- Have your AES account access info ready (account number, SSN).

- Provide payment details (bank or card).

- Confirm the amount and loan to apply it to.

How about an example? Mike, a freelancer, calls AESsuccess to pay $500 after a big gig. The rep confirms it’s applied to his total loan balance, boosting his improving loan literacy.

Cool Tip: Record the confirmation number from the call. It’s proof of payment if anything goes awry.

Mail payments mean sending a check or money order to AESsuccess. It’s old-school but works if you’re not into digital payments. I used this back in the day when I didn’t trust online systems worked well… for a while.

This method suits those without reliable internet or who prefer tangible records. It’s part of AES online services but doesn’t require secure account access. It’s slower, so you need to plan ahead to avoid late fees, which I learned after missing a due date once.

- Write a check or get a money order payable to AESsuccess.

- Include your account number on the mail instructions.

- Send to the address listed on your billing statement (usually PHEAA, PO Box 8141, Harrisburg, PA 17105).

- Mail at least 7-10 days before your due date.

How about an example? Emma, a rural teacher, mails a $200 check with clear payment instructions details. She confirms via the AES account dashboard that it’s applied correctly.

Cool Tip: Use certified mail for tracking (notice how Emma did this?). It ensures your payment isn’t lost in transit.

Third-Party Bill-Payer

Third-party bill payer services, like your bank’s bill pay, let you pay AESsuccess through an external platform. I used my bank’s service when I wanted everything centralized super convenient.

This method integrates with your existing financial setup, streamlining make payments for loan management AES. It’s secure and lets you schedule payments, but you must ensure payment instructions details are correct. I assumed my bank would “figure it out” once 1000% WRONG.

- Log into your bank’s bill pay system.

- Add AESsuccess as a payee using the AES payment portal address.

- Enter your AES account access number.

- Schedule your payment and verify it’s sent on time.

How about an example? Tom sets up his bank to pay $250 monthly to AESsuccess. He double-checks the third-party payment services details, ensuring his student loan repayment stays on track.

Bottom line? AESsuccess gives you tons of ways to tackle student loan repayment, from automated payments to mail payments. Pick what fits your vibe, use the AES borrower portal for tracking, and stay on top of your financial literacy. You’ve got this!

Cool Tip: Check your AES account dashboard a few days after payment. Confirm the payment application to avoid mix-ups.

AESsuccess: Discharge and Loan Forgiveness

I’ll walk you through the ins and outs of loan discharge and forgiveness programs offered through AESsuccess (American Education Services), because trust me, these options can be a game-changer for your student loan repayment journey. Back in the day, I had a friend who thought loan forgiveness was a myth 1000% WRONG.

These programs are real, and knowing how to tap into them can shave thousands off your debt or wipe it out entirely. Whether you’re a teacher, a public servant, or facing unique circumstances, AESsuccess has paths to ease your federal student loans burden. Let’s dive into what these programs are, why they’re critical, and how you can make them work for you using the AES borrower portal.

Teacher Loan Forgiveness

I’ll explain: Teacher Loan Forgiveness is a lifeline for educators working in low-income schools. If you teach full-time for five consecutive years at a qualifying school, you could get up to $17,500 forgiven on your federal student loans (like Direct or FFEL loans).

It’s a huge incentive for teachers, reducing your debt while you serve communities that need you most. Plus, it’s a way to boost your financial literacy by leveraging borrower rights.

- Verify Eligibility: You need to teach full-time for five years at a school listed in the Teacher Cancellation Low-Income Directory. Check your AES account access to confirm your loans qualify.

- Gather Documentation: Collect employment verification from your school. I once helped a colleague who nearly missed this step don’t be that person.

- Submit Forgiveness Forms: Log into the AESsuccess org login, navigate to the AES payment portal, and download the forgiveness forms. Submit them via the portal or mail to AESsuccess.

- Track Your Application: Use the AES borrower portal to monitor your application status. It’s all about loan management AES here.

How about an example? Picture Maria, a math teacher in a Title I school. She logs into her AES online services, confirms her Direct Loans are eligible, and submits her forgiveness forms after five years. Boom $17,500 of her debt vanishes, letting her focus on responsible borrowing for her next career move.

Cool Tip: Save a digital copy of your employment verification. It’s a lifesaver if AESsuccess needs extra proof later.

Loan Discharge

Loan discharge wipes out your loan balance under specific conditions, like school closure or fraud. It’s a rare but powerful option for AESsuccess loan forgiveness. Why? It protects your borrower rights if your school misled you or shut down mid-degree. I knew someone who got burned by a shady for-profit college discharge was their way out.

- Check Discharge Eligibility: Qualifying reasons include school closure, false certification, or unpaid AESsuccess refunds. Visit the AESsuccess org login to review your loan details.

- Collect Evidence: Gather proof, like enrollment records or school closure notices. I once spent hours digging for these start early.

- Submit Forms: Download forgiveness forms from the AES borrower portal and submit with your evidence. Mail or upload them securely.

- Follow Up: Use AES online services to track your application. Patience is key discharge isn’t instant.

How about an example? Jake’s college closed unexpectedly, leaving him with $10,000 in loans. He logs into his AES account access, submits a school closure discharge form, and gets his balance cleared, saving his financial literacy goals.

Here’s the catch: Not all loans qualify, so confirm your situation matches the discharge eligibility criteria.

Cool Tip: Keep a folder of all school-related documents (notice how Jake organized his enrollment papers). It speeds up the discharge process.

Total and Permanent Disability

If you’re facing total and permanent disability (TPD), AESsuccess offers a discharge to erase your federal student loans. This matters because it’s a financial lifeline when you can’t work due to health issues. I’ve seen how medical debt can pile up adding loan relief is huge for debt management resources.

- Confirm Disability Status: You’ll need documentation from the Social Security Administration or a physician. Check requirements via the AESsuccess org login.

- Apply Through Nelnet: TPD discharges are processed by Nelnet, the Department of Education’s partner. Download forms from the AES borrower portal or Nelnet’s site.

- Submit Documentation: Upload or mail your medical proof with the forgiveness forms. I helped a family member with this it’s detailed but doable.

- Monitor Progress: Track your application via AES online services or Nelnet’s portal to ensure loan management AES stays smooth.

How about an example? Sarah, unable to work due to a chronic condition, uses her AES account access to start her TPD discharge. She submits her doctor’s certification, and her $20,000 loan is discharged, easing her financial stress.

Cool Tip: Save a digital backup of your medical documents. It’s handy if you need to resubmit.

Public Service Loan Forgiveness (PSLF)

PSLF (Public Service Loan Forgiveness) forgives your remaining federal student loans after 120 qualifying payments while working full-time for a government or nonprofit employer. It’s a big deal for public servants like nurses or teachers, aligning with promoting responsible lending practices. I thought PSLF was too good to be true until I saw a coworker get $50,000 forgiven.

- Verify Employment: Work full-time for a qualifying employer (check via the PSLF Help Tool on the Department of Education’s site).

- Submit ECFs: Use AESsuccess org login to download Employment Certification Forms (ECFs). Submit them annually to track your 120 payments.

- Make Qualifying Payments: Pay on an income-driven repayment plan via the AES payment portal. Use AES online services to confirm payments count.

- Apply for Forgiveness: After 120 payments, submit the PSLF application through the AES borrower portal.

How about an example? Lisa, a social worker, logs into her AES account access, submits annual ECFs, and after 10 years, applies for PSLF. Her $40,000 balance is forgiven, boosting her financial literacy.

Here’s the catch: You must be on an income-driven plan for payments to count standard plans can be 1000% WRONG for PSLF.

Cool Tip: Set a calendar reminder to submit your ECF yearly. It keeps your PSLF progress on track.

Death

Loan discharge death cancels federal student loans if the borrower passes away. It’s a tough topic, but it matters for protecting co-signers and families from debt. I’ve seen families stress over this knowing the process brings peace of mind.

- Notify AESsuccess: A family member or representative must contact AESsuccess via the AESsuccess org login or customer service (1-800-233-0557).

- Submit Proof: Provide a death certificate or equivalent. Upload it via the AES borrower portal or mail it.

- Follow Up: Track the discharge status using AES online services to ensure the deceased account holder guidance is followed.

How about an example? After a borrower’s passing, their spouse uses the AES payment portal to submit a death certificate. The $15,000 loan is discharged, easing the family’s burden.

Bottom line? AESsuccess loan forgiveness and discharge programs are powerful tools for student loan repayment. By leveraging AES account access and loan counseling, you can navigate these options to achieve a secure financial future. Don’t sleep on these opportunities they’re your ticket to less debt stress.

Cool Tip: Keep a secure digital copy of the death certificate (notice how the spouse saved it in a cloud folder). It simplifies resubmissions if needed.

AESsuccess: Bills and Notices

Your AESsuccess bills and notices are your lifeline to managing your student loan account. They include the monthly bill, direct debit statement, reduced payment bill, interest bill, and interest notice, each vital for responsible borrowing.

By mastering these, you avoid late fees, track payment history, and make savvy choices via the AES payment portal. They’re your toolkit for simplifying loan repayment and securing your financial future.

| Bill/Notice Type | Description |

|---|---|

| Monthly Bill | Details your monthly payment, due date, and payment history for federal student loans or private student loans. |

| Direct Debit Statement | Shows automated payments deducted, highlighting direct debit benefits for seamless loan servicing. |

| Reduced Payment Bill | Lists adjusted payments for income-driven repayment plans, tailored to your budget. |

| Interest Bill | Outlines interest owed, clarifying interest accrual and its effect on your total loan balance. |

| Interest Notice | Alerts you to interest vs. principal trends, guiding decisions to cut loan servicing costs. |

By staying on top of each notice type, you stay ahead of your debt. No surprises just smart, informed loan management.

Monthly Bill

The monthly bill is the heartbeat of your student loan repayment with AESsuccess. It shows what you owe, when it’s due, and how payments apply, keeping your AES account access crystal clear.

Skipping it? Big mistake I got hit with a late fee once for that. Use the AESsuccess org login to view, download, or pay it through the AES payment portal for smooth bill management.

- Log In: Hit the AES account dashboard via AESsuccess org login (www.aessuccess.org) to check your monthly bill.

- Verify Details: Confirm due date, amount, and payment history. I missed a $15 overpayment once small, but it matters!

- Pay Online: Use the AES payment portal for online payments or set up automated payments.

- Go Paperless: Enable email alerts in AES online services to stay on top of bills, boosting responsible borrowing.

- Get Help: Call AESsuccess at 1-800-233-0557 for questions on federal student loans or private student loans.

This bill keeps your student loan account in check. Stay proactive with the AES account dashboard for stress-free bill management.

How about an example? Lisa, a teacher with $20,000 in federal student loans, logs into the AES borrower portal, sees her $250 monthly bill due on the 15th, and pays via online payments. Her payment history stays clean, securing her financial future.

Cool Tip: Save each monthly bill as a PDF to track payments. It’s a quick way to monitor loan servicing trends.

Direct Debit Statement

The direct debit statement tracks your automated payments, showing bank deductions for your student loan repayment. It’s a lifesaver for staying consistent with loan servicing.

I set this up years ago worked well… until I forgot to update my bank info, causing a missed payment. Check it monthly via the AES borrower portal to avoid hiccups.

- Access It: Log into AESsuccess org login to view your direct debit statement in the AES account dashboard.

- Check Deductions: Ensure amounts match your monthly bill. I once caught a bank error this way saved me a headache!

- Update Bank Info: Use the AES payment portal to update accounts, ensuring direct debit benefits.

- Confirm Payments: Verify deductions align with your payment history for responsible borrowing.

- Contact Support: Call 1-800-233-0557 if deductions seem off, keeping your financial literacy sharp.

Simple. This statement ensures automated payments run like clockwork. Use the AES payment portal to stay on track.

How about an example? Tom, with $30,000 in private student loans, checks his direct debit statement monthly. He spots an incorrect $200 deduction, updates his bank info via AES online services, and keeps payments smooth.

Cool Tip: Set a monthly reminder to review your direct debit statement. It’s a fast way to catch errors and maintain loan management.

Reduced Payment Bill

The reduced payment bill shows adjusted payments for income-driven repayment plans, tailored to your income. It’s a game-changer for affordable student loan repayment.

I ignored mine once, assuming it was the same as my monthly bill 1000% WRONG. Always review it in the AES borrower portal to align with your budget.

- Log In: Access your reduced payment bill via AESsuccess org login in the AES account dashboard.

- Verify Adjustments: Check if payments reflect your income-driven repayment plan. I caught a miscalculation once!

- Pay On Time: Use the AES payment portal for online payments to avoid late fees.

- Recertify Income: Update income annually in AES online services to keep payments affordable, supporting responsible borrowing.

- Ask Questions: Call 1-800-233-0557 for clarity on federal student loans adjustments.

This bill makes loan management affordable. Stay vigilant with the AES account dashboard to keep payments manageable.

How about an example? Sarah, a social worker with $25,000 in federal student loans, sees her reduced payment bill drop to $100 monthly. She pays via online payments, keeping her payment history solid.

Cool Tip: Download your reduced payment bill to compare with past bills. It’s a simple way to track loan servicing changes.

Interest Bill

The interest bill details interest owed on your student loan account, showing how interest accrual impacts your total loan balance. It’s key for financial literacy.

I once skipped paying interest, thinking it’d be a big mistake, as it capitalized. Review it via the AES payment portal to save money long-term.

- Access It: Log into AESsuccess org login to view your interest bill in the AES account dashboard.

- Understand Charges: Check how much interest is due and its effect on interest vs. principal. I saved $50 by paying early once!

- Pay Extra: Use the AES payment portal to tackle interest before it grows, easing loan servicing.

- Set Alerts: Enable notifications in AES online services for new interest bills, promoting responsible borrowing.

- Get Help: Call 1-800-233-0557 for questions on interest accrual for private student loans.

This bill keeps interest vs. principal in check. Use the AES borrower portal to stay ahead of costs.

How about an example? Mike, with $15,000 in federal student loans, sees a $75 interest bill. He pays it via online payments, reducing his total loan balance and boosting his financial future.

Cool Tip: Pay your interest bill early to minimize interest accrual. It’s a smart move for simplifying loan repayment.

Interest Notice

The interest notice alerts you to interest accrual trends, helping you decide how to manage interest vs. principal. It’s a nudge for proactive loan management.

I ignored one once, and my balance crept up lesson learned. Check it regularly in the AES account dashboard to make informed choices.

- Log In: Access your interest notice via AESsuccess org login in the AES account dashboard.

- Analyze Trends: Note how interest accrual affects your total loan balance. I spotted a pattern this way!

- Act Fast: Use the AES payment portal to pay interest early, reducing loan servicing costs.

- Stay Informed: Enable email alerts in AES online services for new interest notices, aiding responsible borrowing.

- Seek Clarity: Call 1-800-233-0557 for help with federal student loans or private student loans.

This notice guides your student loan repayment. Leverage the AES payment portal for a secure financial future.

How about an example? Emma, with $10,000 in private student loans, gets an interest notice showing $40 monthly interest. She pays extra via online payments, keeping her payment history strong.

Bottom line? Mastering AESsuccess bills and notices is your ticket to simplifying loan repayment. Use AES online services to stay organized and keep your student loan account on track.

Cool Tip: Save interest notices in a folder to track interest vs. principal over time. It’s a quick way to stay on top of financial literacy.

Advantages of AESsuccess

I’ll walk you through why AESsuccess (American Education Services) is a must for student loan repayment. I once struggled with federal student loans and messy paper statements user-friendly loan tools changed everything. The AES borrower portal makes loan management AES so easy, you’ll wonder why you didn’t start sooner.

With the AESsuccess org login, you get tools to simplify manage AES loans tasks. From tracking payments to boosting financial literacy, it’s all about empowering student borrowers. Let’s dive into how you can use these perks.

- AES Borrower Portal: Log in via AESsuccess org login to check loan status and payment history (so intuitive).

- Flexible Payments: Use the AES payment portal for one-time or automatic payments, dodging late fees.

- Mobile Access: The AES mobile app lets you handle access my student loan account AES on the go.

- Educational Tools: Loan counseling and calculators enhance financial literacy for smarter responsible borrowing.

- Borrower Support: Explore borrower rights like loan forgiveness with clear debt management resources.

How about an example? Take Lisa, a nurse with $35,000 in federal student loans. She uses the AESsuccess org login to set up automatic payments via the AES payment portal and checks her total loan balance on the AES mobile app. With loan counseling, she plans her student loan repayment, saving time and stress.

Here’s the catch: Skip these tools, and you’re stuck with chaos. I missed a payment once by ignoring the AES borrower portal don’t be me.

AESsuccess’s AES online services make loan management AES a breeze. You’ll feel like a pro tackling your loans.

Cool Tip: Set up alerts in the AES mobile app for payment reminders. It’s a game-changer for manage AES loans effortlessly.

AESsuccess Benefits for Servicemembers

If you’re a servicemember, I’ll show you how AESsuccess delivers top-notch military loan benefits. Growing up with a veteran dad, I saw loan stress during deployments borrower support from AESsuccess is a lifesaver. Their loan servicing keeps student loan repayment simple, even on active duty.

The AES account access gives you tools to manage federal student loans stress-free. From debt management resources to government loan policies, you’re set for responsible borrowing. Here’s how to make it work.

- SCRA Rate Cap: Get a 6% interest cap on federal student loans during active duty, lowering your total loan balance.

- Deferment Options: Pause payments via the AES borrower portal during deployments (huge relief).

- Loan Forgiveness: Use loan counseling to explore Public Service Loan Forgiveness (PSLF) for qualifying roles.

- Dedicated Support: Borrower support helps navigate government loan policies (call 1-800-233-0557).

- Mobile Tools: Check loan status with the AES mobile app, even overseas.

How about an example? Meet Sam, a Marine with $15,000 in federal student loans. He logs into AESsuccess org login, applies a 6% SCRA cap via the AES payment portal, and pauses payments during deployment. Loan counseling helps him plan for career prospects after graduation.

Here’s the catch: You must request military loan benefits they’re not automatic. A buddy missed an interest cap by not asking 1000% WRONG.

AESsuccess’s AES online services make loan management AES seamless for servicemembers. Focus on your duty, not your debt.

Cool Tip: Check SCRA eligibility in the AES mobile app before deployment. It’s a quick way to save on student loan repayment.

AESsuccess Mobile App

I’ll walk you through the AES mobile app, a lifesaver for managing your student loan repayment on the go. Back in the day, I’d scramble to find a computer to check my federal student loans now, the AES borrower portal in my pocket does it all. It’s packed with mobile app features that make loan management AES a breeze, and I’m pumped to show you how it works.

The AES mobile app lets you handle access my student loan account AES anywhere. From mobile payments to loan summary mobile, it’s all about simplifying loan repayment. You’ll love the freedom it gives you.

Getting Started with the App

I’ll explain: The AES mobile app is your portable AES online services hub for federal student loans. It offers individual loan details mobile, payment options, and financial literacy tools. I once thought apps were overrated 1000% WRONG.

You can check your loan status or make mobile payments during a coffee break, keeping responsible borrowing on track. The app’s borrower support ensures you’re never lost. It saved me from missing a payment once.

- Download the App: Grab it from the App Store or Google Play using AESsuccess login credentials.

- Log In Securely: Use your AES account access to view the AES borrower portal on your phone.

- Explore Features: Check loan summary mobile, pay via AES payment portal, or use loan counseling tools.

- Set Alerts: Enable notifications for payment due dates to manage AES loans effortlessly.

How about an example? Picture Alex, a teacher with $20,000 in federal student loans. He uses the AES mobile app to check individual loan details mobile during a break, makes a mobile payment, and reads financial literacy tips. This keeps his student loan repayment stress-free.

Here’s the catch: You need an AESsuccess org login to use the app. I tried using an old password once didn’t work out well. Simple. The AES mobile app makes loan servicing feel like a walk in the park. You’ll wonder how you lived without it.

Cool Tip: Pin the AES mobile app to your phone’s home screen. It’s a quick way to manage AES loans without digging through menus.

AESsuccess’s Credit Reporting and Your Student Loans

I’ll walk you through how AESsuccess (American Education Services) manages AESsuccess credit reporting for your credit score. Back in the day, I ignored my student loan repayment details, thinking they wouldn’t hurt my credit 1000% WRONG. The AES borrower portal boosts your financial literacy and keeps your credit shining.

AESsuccess credit reporting tracks federal student loans and student loan repayment, impacting your credit score for loans or rentals. Use AES online services to manage AES loans and avoid dings. I learned this after a late payment hit my credit don’t be me.

| Module | Description |

|---|---|

| Understanding Your Credit Score | How student loan credit impact affects your credit score and building good credit. |

| Credit Reports vs. Credit Scores | Differences between credit reports and credit scores in AESsuccess credit reporting. |

| Submitting a Credit Dispute | Steps to file a credit dispute for errors via access my student loan account AES. |

| What Happens After You Submit a Dispute | Process and timeline for credit dispute resolution with borrower support. |

| Addressing Credit Reporting Errors | How to correct AESsuccess credit reporting errors via credit dispute processes. |

| Managing Your Student Loan Account | Tips to manage student loan account for credit score improvement and responsible borrowing. |

Simple. Leverage AESsuccess org login for loan servicing and credit protection. You’ll master empowering student borrowers in no time.

Understanding Your Credit Score

Your credit score shows how you manage federal student loans in AESsuccess credit reporting. I once thought loans didn’t affect credit 1000% WRONG. The AES borrower portal reveals your student loan credit impact.

A strong credit score helps with mortgages or rentals. Timely student loan repayment via AES payment portal supports building good credit. I skipped checking my score early big mistake.

Use AES account access to monitor your credit score. Log into AESsuccess org login for payment tracking and borrower support. Here’s how to stay proactive.

- Check Often: Review payment history in access my student loan account AES for credit score improvement.

- Pay Promptly: Set automatic payments in AES payment portal for responsible borrowing.

- Learn More: Use loan counseling to understand student loan credit impact on building good credit.

How about an example? Sarah checks her credit score via AES online services. Timely manage AES loans payments boost her score, securing a credit card.

Here’s the catch: Late loan servicing payments lower your credit score. I missed one my score dropped.

Cool Tip: Set a reminder to check your credit score via AESsuccess org login monthly. It’s easy for empowering student borrowers.

Credit Reports vs. Credit Scores

Credit reports list your federal student loans history, while credit scores rate your creditworthiness in AESsuccess credit reporting. I thought they were identical 1000% WRONG. AES borrower portal explains both clearly.

Credit reports detail payment history, affecting student loan credit impact. Errors in credit reports can hurt your credit score, but timely student loan repayment helps. Financial literacy via AES online services is crucial.

Use AES account access to check credit reports and credit scores. Log into AESsuccess org login to ensure responsible borrowing. Here’s how to do it.

- Review Reports: Check credit reports in access my student loan account AES for accuracy.

- Learn Scores: Loan counseling shows how credit scores reflect student loan credit impact.

- Fix Issues: Contact borrower support for credit reports errors to aid credit score improvement.

How about an example? Mike confirms payments via AES payment portal, then checks credit reports on AESsuccess org login. Fixing an error supports building good credit.

Here’s the catch: Unchecked credit reports hide errors, harming your credit score. I ignored mine once bad call.

Cool Tip: Download credit reports yearly via AES online services. It’s free and boosts empowering student borrowers.

Submitting a Credit Dispute

Submitting a credit dispute fixes errors in AESsuccess credit reporting for federal student loans. I thought errors self-corrected 1000% WRONG. AES borrower portal makes credit dispute filing simple.

Disputing errors ensures credit score improvement and accurate student loan credit impact. Correct credit reports support building good credit and financial goals. Borrower support via AES online services helps you.

File a credit dispute with AES account access. Use AESsuccess org login to submit via access my student loan account AES. Here’s the process.

- Find Errors: Check credit reports in AES payment portal for wrong student loan repayment data.

- Collect Proof: Gather payment records from manage AES loans for your credit dispute.

- Submit Online: File via AES online services for fast resolving loan disputes.

How about an example? Emma spots a false late payment in credit reports via AESsuccess login. She files a credit dispute on AES borrower portal, fixing her credit score.

Here’s the catch: Ignoring AESsuccess credit reporting errors hurts your credit score. I delayed disputing huge mistake.

Cool Tip: Save payment confirmations from AES payment portal. They’re key for submitting a credit dispute.

What Happens After You Submit a Dispute?

Credit dispute resolution follows submitting a credit dispute in AESsuccess credit reporting. I thought disputes fixed instantly 1000% WRONG. AES online services detail the after credit dispute process.

Resolving loan disputes protects credit score improvement and student loan credit impact. A corrected credit report supports building good credit. Borrower support keeps you updated.

Track credit dispute resolution with AES account access. Check AESsuccess org login for manage AES loans accuracy. Here’s how to stay on top.

- Check Status: Monitor updates in access my student loan account AES for your credit dispute.

- Send Docs: Provide extra info via AES payment portal if borrower support asks.

- Verify Fix: Confirm credit reports post-resolution for credit score improvement.

How about an example? Jake files a credit dispute via AES borrower portal. He tracks it on AESsuccess org login, sees the fix, and boosts his credit score.

Here’s the catch: Not tracking after credit dispute leaves errors. I forgot once my score suffered.

Cool Tip: Set a weekly reminder to check credit dispute resolution via AES online services. It speeds up resolving loan disputes.

Addressing Credit Reporting Errors

If you spot errors in AESsuccess credit reporting for federal student loans, you can file a credit dispute. I assumed AES fixed errors automatically 1000% WRONG. AES borrower portal lets you address issues directly.

Correcting errors ensures credit score improvement and accurate student loan credit impact. This supports building good credit and responsible borrowing. Financial literacy via AES online services guides you.

Use AES account access to submit a credit dispute. Log into AESsuccess login or mail documents for resolving loan disputes. Here’s how to do it.

- Online Dispute: File via access my student loan account AES after AESsuccess org login (fastest method).

- Mail Dispute: Send the Direct Credit Dispute Form to AES Credit, P.O. Box 61047, Harrisburg, PA 17106-1047, with your name, account number, disputed items, and proof.

- Bureau Dispute: Submit directly to Equifax, Experian, or TransUnion; AES will investigate if notified.

- Expect Updates: AES investigates within 30 days, sending letters/emails via borrower support.

- Check Resolution: After AES requests changes, confirm updates with bureaus in 30 days for credit score improvement.

How about an example? Lily finds a misreported payment in credit reports via AES payment portal. She submits a credit dispute online, and AES corrects it, boosting her credit score.

Here’s the catch: Not filing a credit dispute leaves errors in AESsuccess credit reporting. I ignored one my credit took a hit.

Cool Tip: Download the Direct Credit Dispute Form from AES online services. It’s a quick start for resolving loan disputes.

Managing Your Student Loan Account

Manage student loan account to protect your credit score with AESsuccess credit reporting. I slacked on manage AES loans once 1000% WRONG. AES online services make it effortless.

Effective loan management AES ensures student loan credit impact supports building good credit. It’s vital for financial literacy and responsible borrowing. Borrower support drives credit score improvement.

Use AES account access to stay proactive. Monitor student loan repayment via AESsuccess org login for empowering student borrowers. Here’s how to nail it.

- Track Payments: Check AES payment portal for timely student loan repayment.